When most people think about getting a mortgage, they focus on things like income, credit score, and down payment. But there’s another side to mortgage approval that often gets overlooked — the property itself.

Many lenders have very specific requirements about the types of homes they’re willing to finance. These rules can affect everything from minimum square footage to where the property is located. Knowing these details in advance can help buyers avoid disappointment and help sellers better understand what could make their property harder to sell.

Minimum Property Sizes: When Small Becomes a Big Problem

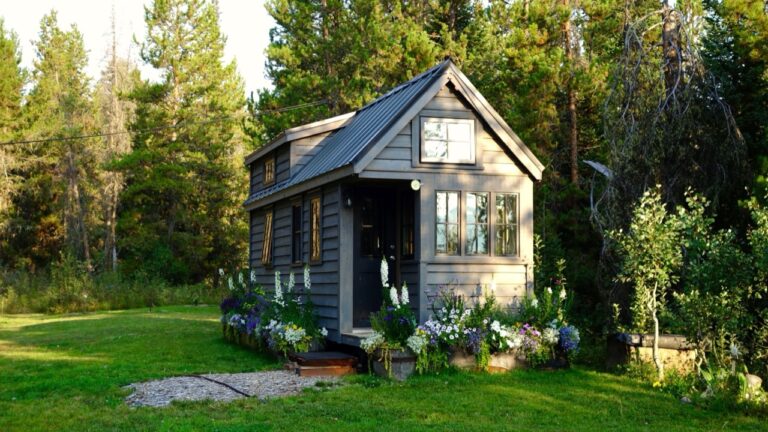

Some lenders won’t consider homes or condos that fall below a certain size. These minimum square footage requirements can range widely, but it’s not unusual to see lenders decline properties under 400 to 850 square feet, depending on the type and location.

Why does this matter? Because a growing number of Canadians are interested in smaller homes and condos — particularly in cities where affordability is a concern. While micro-suites and compact condos can be a great lifestyle choice, they may not always meet a lender’s internal standards.

The reason behind these policies comes down to resale risk. Smaller properties are generally harder to sell, and lenders want to make sure that if they ever have to take possession, the home can be resold quickly and retain its value.

For example, a 400-square-foot condo might seem perfect for a buyer looking to live downtown, but some lenders will only consider units 500 square feet or larger. Detached homes can face similar challenges, with certain lenders requiring minimums closer to 700 or 800 square feet.

If you’re thinking of buying a smaller property, it’s important to confirm that it meets lender requirements before you commit.

When Location Becomes a Limitation

It’s not just size that can cause an issue. Some lenders also have geographic restrictions, meaning they’ll only lend on properties located within a certain distance of their main lending centres.

This can be especially important for buyers considering homes in smaller towns, rural areas, or cottages. A property that’s too far from a major urban area might fall outside a lender’s comfort zone — even if it’s otherwise in great condition.

In some cases, lenders also require year-round access, which means seasonal or remote properties with limited road access might not qualify. These restrictions exist because lenders want to reduce risk in markets where resale demand may be limited or property values can fluctuate.

Why These Rules Exist

From the lender’s point of view, these restrictions help manage risk and protect their investment. Properties that are very small, remote, or hard to access can be more difficult to sell quickly in the event of default.

While that makes sense from a lending perspective, it can create real challenges for buyers and sellers who are unaware of these policies until late in the process.

That’s why understanding these guidelines ahead of time can save a lot of stress — and potentially a lot of money.

What Buyers and Sellers Should Know

If you’re a buyer, the most important thing you can do is confirm the property’s eligibility before making an offer. Even if you’re financially qualified, a lender might still reject your application if the home doesn’t meet their internal criteria.

If you’re a seller, it’s equally valuable to know how these restrictions affect potential buyers. A home that’s too small or too remote may have a smaller pool of qualified purchasers, which can impact pricing and how quickly it sells.

Both sides benefit from understanding the limits of what lenders will — and won’t — approve.

When Exceptions Are Possible

In some cases, exceptions can be made. For example, a property that doesn’t meet a lender’s standard minimums might still qualify through a specialized or alternative lender. However, this often means higher interest rates or more restrictive terms, since these lenders are taking on additional risk.

That doesn’t mean the deal can’t be done — but it does mean having realistic expectations and getting professional advice early in the process. Working with someone who understands these nuances can help you find creative solutions and avoid unnecessary delays.

How The Local Broker Can Help

At The Local Broker, we understand that every property — and every buyer — is different. Our role is to help you navigate these restrictions and match your situation with the right lender.

Because we’re independent, we have access to a wide network of banks, credit unions, and alternative lenders. That flexibility allows us to find solutions even when a property falls outside the standard lending guidelines.

Whether you’re buying your first home, refinancing, or preparing to sell, we can help you understand what’s realistic and plan your next steps with confidence.

Reach out to The Local Broker today to discuss your situation. A quick conversation could help you avoid unexpected obstacles — and get you one step closer to making the right move.