If you’re searching for a Guelph mortgage, you’re likely facing one of the biggest financial decisions of your life. Whether you’re buying your first home, upgrading, or refinancing an existing mortgage, understanding your options is essential.

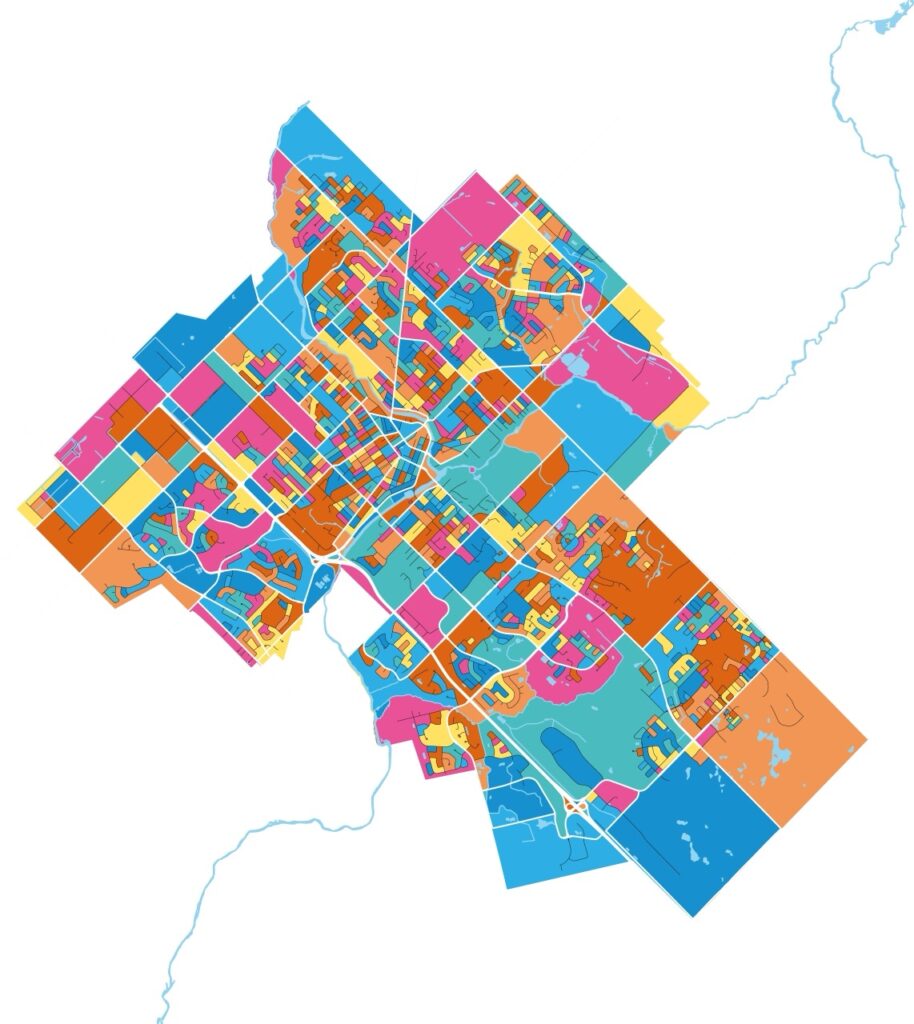

Guelph continues to be one of Ontario’s most desirable cities for families, professionals, and retirees alike. With strong community values, a growing job market, and a mix of heritage homes and new builds, it’s no surprise demand for homes remains high. But how do you find the right mortgage in this fast-moving market?

At The Local Broker, we’re based right here in Guelph and understand the local market inside and out. Here’s what you need to know when it comes to securing a mortgage in this city.

Why Work with a Guelph Mortgage Broker?

Choosing a local mortgage broker means you’re not limited to one bank or lender. We shop the entire market—including big banks, credit unions, and alternative lenders—to find the best solution for your situation. That could mean a better rate, better terms, or both.

We also understand the local housing market in Guelph. That includes how much house you can realistically afford in a neighbourhood like Exhibition Park, or whether it’s worth looking at pre-construction options on the city’s south end. We’ll help you align your mortgage with your long-term financial goals.

Ready to explore your options? Start your application here.

What Type of Guelph Mortgage Do You Need?

Depending on your goals, there are several types of mortgages to consider:

- Fixed-Rate Mortgages: Ideal if you want consistent monthly payments.

- Variable-Rate Mortgages: Good if you’re comfortable with some fluctuation and want to benefit from potential rate drops.

- Refinancing: If you already own a home in Guelph and want to tap into your equity, pay off debts, or secure a lower interest rate.

- First-Time Homebuyer Mortgages: With access to incentives and rebates, we’ll guide you through what’s available in Ontario.

- Self-Employed Mortgages: We work with lenders that understand non-traditional income streams.

If you’re not sure which option is best, we’ll walk you through it. Every situation is unique—and every mortgage should be too.

How the Guelph Market Affects Your Mortgage

The real estate market in Guelph remains competitive, even in the face of rising interest rates. That makes pre-approval more important than ever. It gives you an edge when you’re making an offer, and it sets a clear budget so you can shop with confidence.

With neighbourhoods ranging from family-friendly Kortright Hills to the downtown core, home prices vary significantly. We help you assess how much mortgage you’ll qualify for—and just as importantly, how much you’ll feel comfortable paying each month.

Want a clearer picture of what you can afford? Try our mortgage affordability calculator.

Local Service, Real Results

Because we’re a small business based in Guelph, we can move quickly, answer your questions directly, and provide a level of personal service the big banks simply can’t match. We’re not tied to any single lender, and we’re not limited to bank hours. We’re available when you need us—by phone, email, or in person.

We also serve surrounding communities like Fergus, Elora, Rockwood, and Puslinch. And while we’re local to Guelph, we help clients all across Ontario through our fully online mortgage process.

Let’s Get Started

Whether you’re buying your first home in Guelph or thinking about refinancing, we’re here to help you make the right decision. Apply now or get in touch and let’s talk about what kind of mortgage works best for you.